41 changes to defined benefit pensions

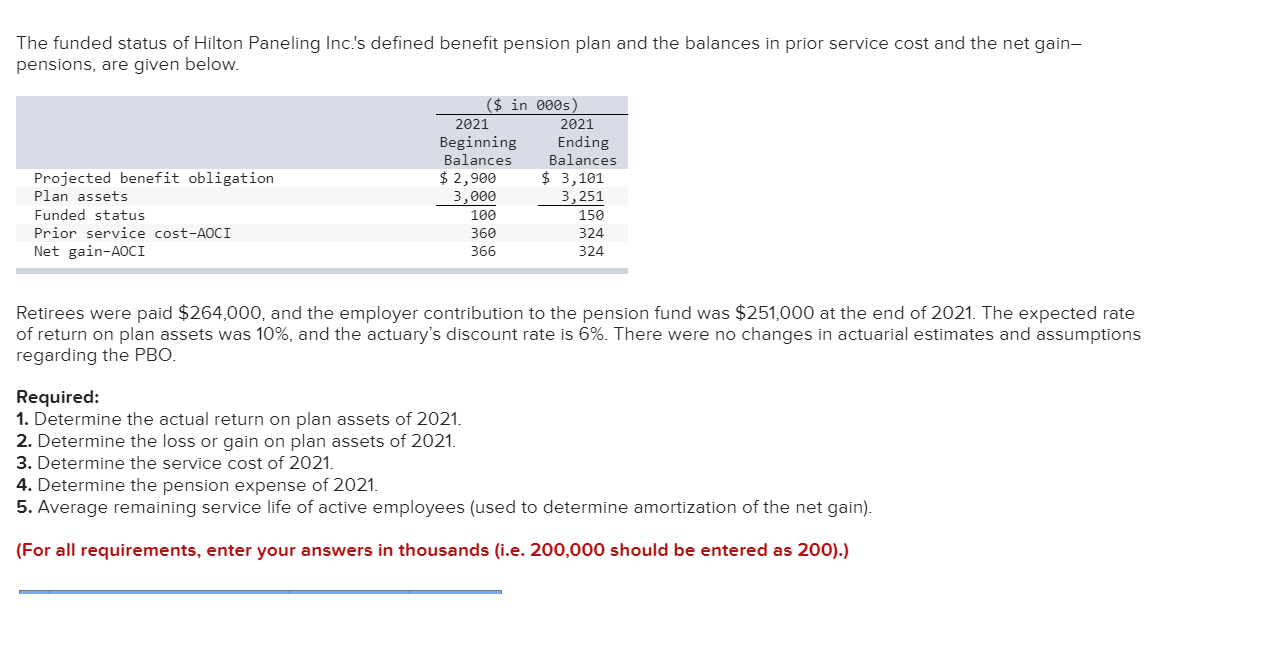

PDF Types of Defined Benefit Pension Plans Types of Defined Benefit Pension Plans » Single-Employer Plan . is a defined benefit pension plan that provides pensions to the employees of only one employer. » Agent Multiple-Employer Plan . is a defined benefit pension plan in which pension plan assets are pooled for investment purposes but separate accounts are maintained for each Britain's great pension robbery - why the 'defined ... An employee's defined benefit pension became the norm after World War II and private sector pensions peaked in 1967 with more than 8m active members. During an employee's working life, they ...

2021/22 budget changes affecting pensions - BAE Systems In the budget given on 3 March 2021, two announcements affected pensions, namely the Lifetime Allowance and the State Pension. Lifetime Allowance The most significant change announced was that the Lifetime Allowance is to be frozen at its 2020/21 level of £1,073,100 for tax years 2021/22 through to 2025/26.

Changes to defined benefit pensions

Defined benefit pensions - The Private Office It's possible for an employer or trustee to make changes to a defined benefit pension scheme, however the ability to make changes should be set out in your scheme's rules. It's important the rules are followed, and you must be consulted. Section 67 of the Pensions Act 1995 applies to all occupational pension schemes with more than one member. › pers › PagesState of Oregon: Public Employees Retirement System ... PERS provides some online publications in .pdf format. To view them, you must have the most recent version of Adobe Reader ®. Download the latest version of Adobe Reader ®. Employers be aware - big changes to the defined benefit ... Some of the biggest changes to the defined benefit pensions landscape in recent years come into force on 1 October 2021. Much has already been made of the provisions of the Pension Schemes Act 2021. Here is a rundown of what comes into force on 1 October (note that these provisions do not have retrospective effect):

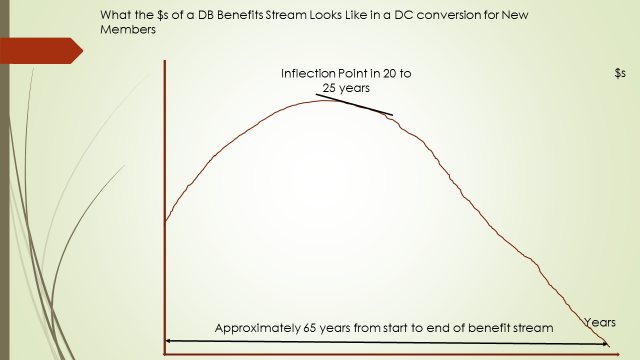

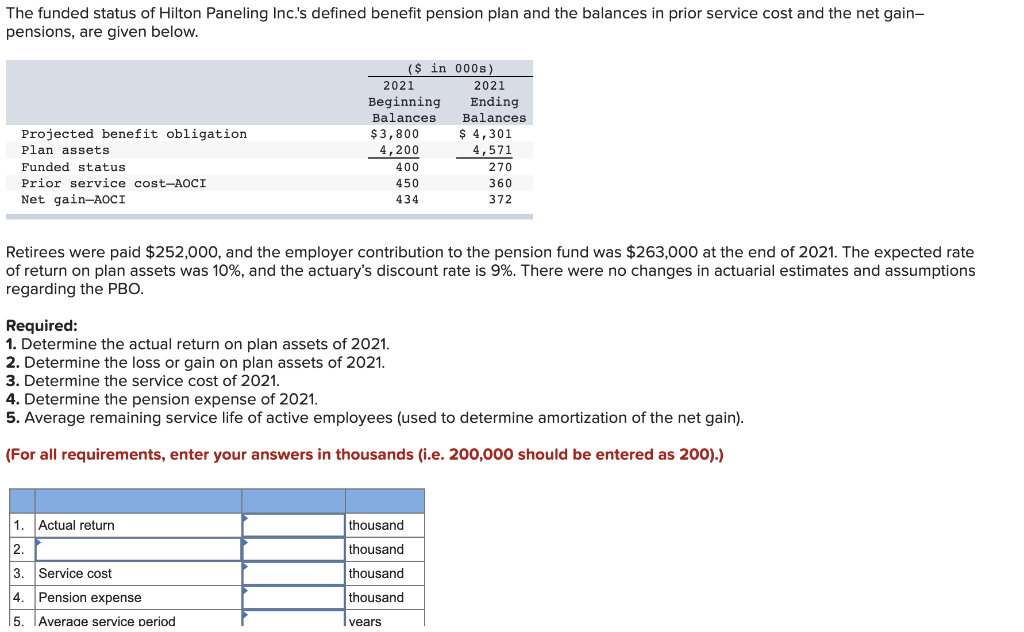

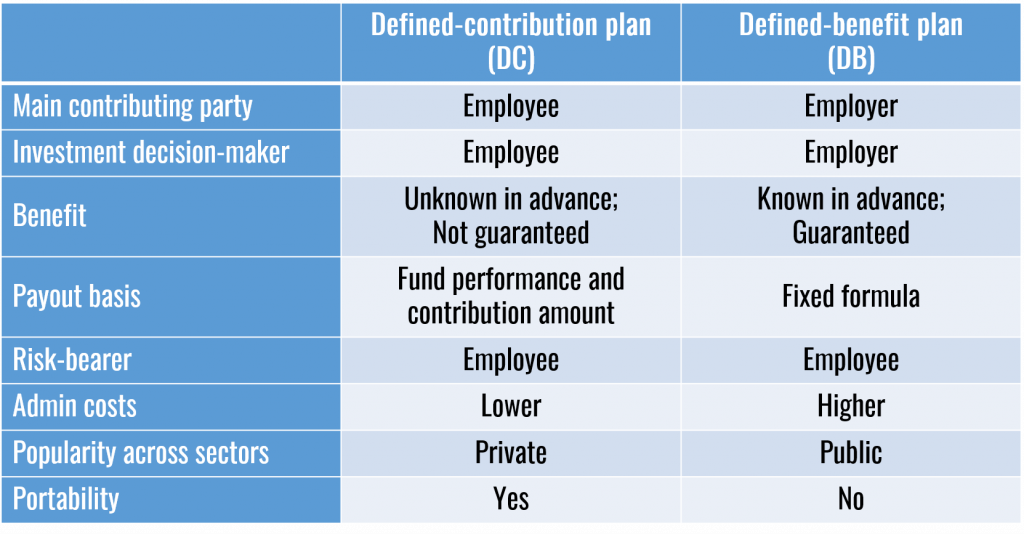

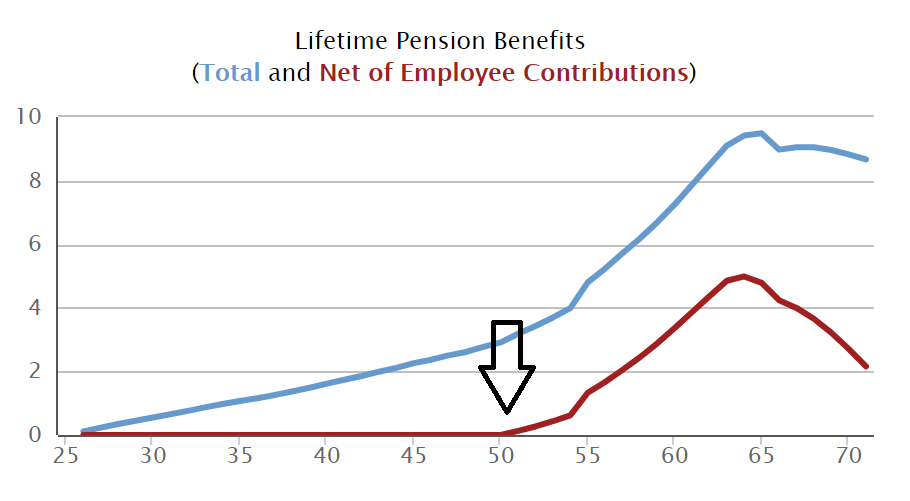

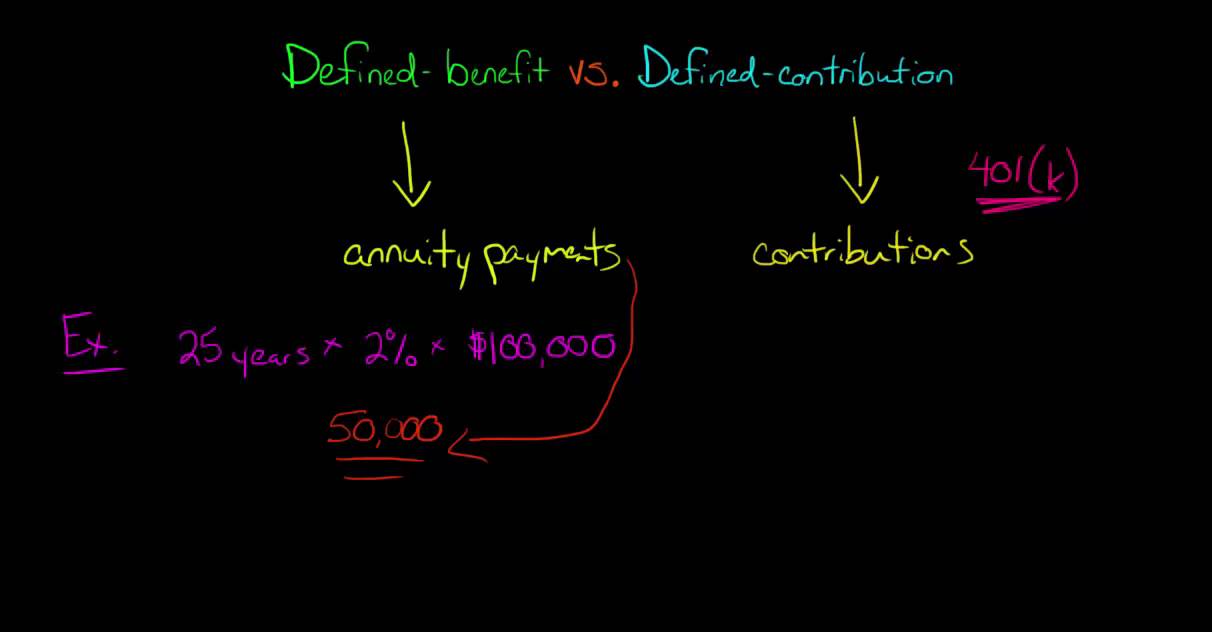

Changes to defined benefit pensions. What is a Defined Benefit Pension Plan? - DBA The difference between defined benefit and defined contribution pension plans is that, instead of providing a defined income after retirement, a defined contribution plan empowers an employee to contribute a fixed percentage of their income to their benefit. The employer then deposits that contribution on their behalf. Understanding the Rules for Defined-Benefit Pension Plans Defined-benefit pension plans are funded by an employer from a company's profits and generally do not require employee contributions. The amount of each individual's benefits is usually linked ... Defined benefit fee change means pension transfers 'only ... Defined benefit fee change means pension transfers 'only available to wealthy' 0 Written by: Paloma Kubiak 05/06/2020 The City regulator has banned contingent charging on defined benefit pension transfers, leading industry experts to fear the move will restrict access to advice on this crucial financial decision. The Disappearing Defined Benefit Pension and Its Potential ... In addition, pension wealth can decline for workers who remain on the job past the plan's retirement age if the increase in annual benefits from an additional year of work is insufficient to offset the loss caused by a reduction in the number of pension installments.

Single-Employer Defined Benefit Pension Plans: Funding ... Single-Employer Defined Benefit Pension Plans: Funding Relief and Modifications Congressional Research Service 1 Introduction A pension is a voluntary benefit offered by employers to assist employees in preparing for retirement. Pension plans may be classified according to whether they are (1) defined benefit PDF Changes to Defined Benefit Plan Disclosures - BKD Changes to Defined Benefit Plan Disclosures As part of its multiyear disclosure framework project, the Financial Accounting Standards Board (FASB) recently finalized updates to annual disclosure requirements for employers that sponsor defined benefit pension or other postretirement benefit plans. Final salary defined benefit schemes - The Pensions Authority Final salary defined benefit schemes Final salary defined benefit (DB) schemes are occupational pension schemes that provide a set level of pension at retirement, the amount of which normally depends on your service and your earnings at retirement or in the years immediately preceding retirement. PDF Changes to RBS's UK Defined Benefit pension schemes Based on earnings —RBS Defined Benefit pension schemes were 'contracted out' of State Second Pension —Hence, employer and employee paid a lower rate of National Insurance —Bank unable to 'contract out' of the New State Pension —National Insurance contributions (paid by both employer and employee) did increase 7

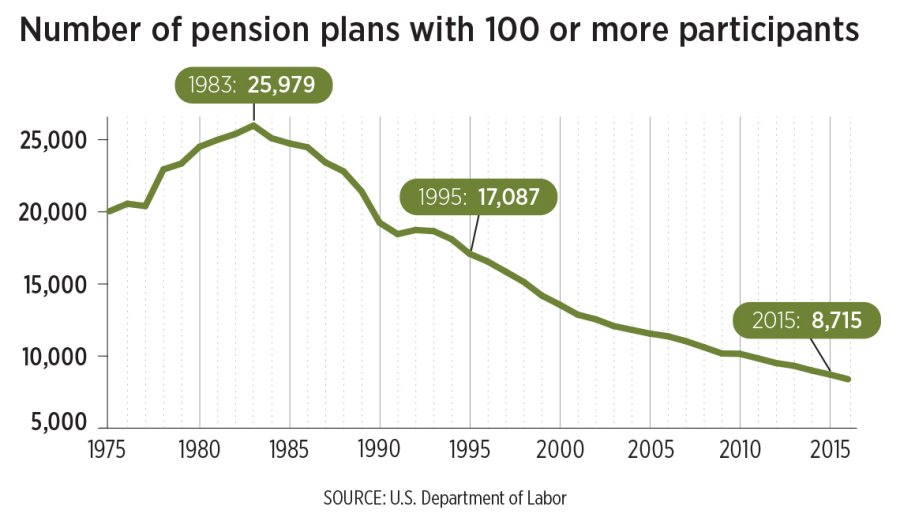

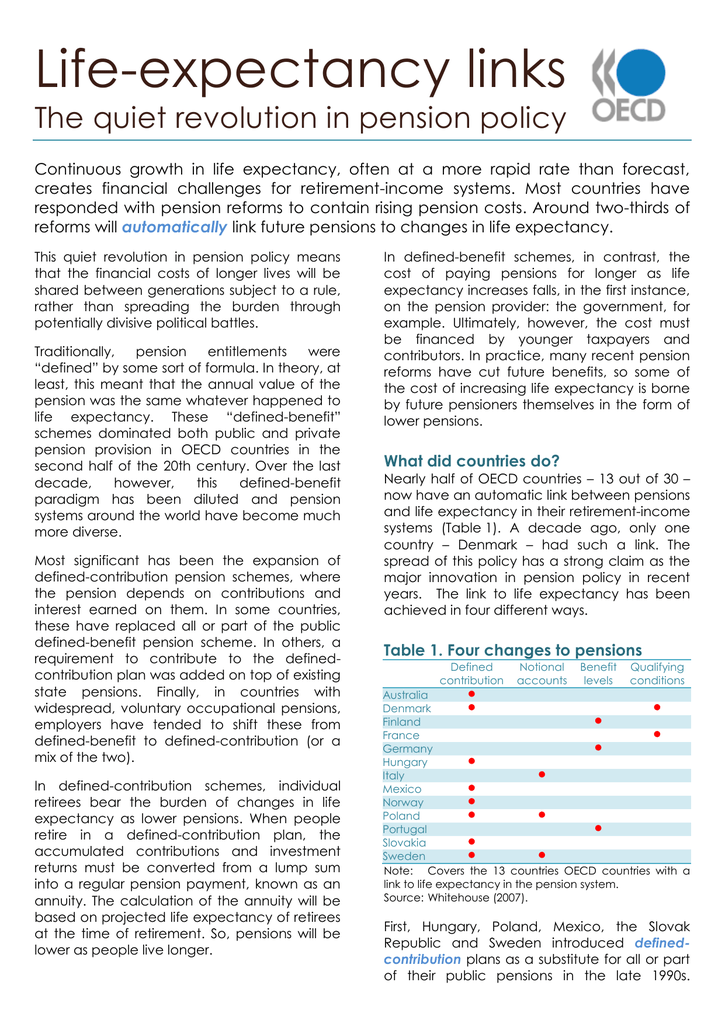

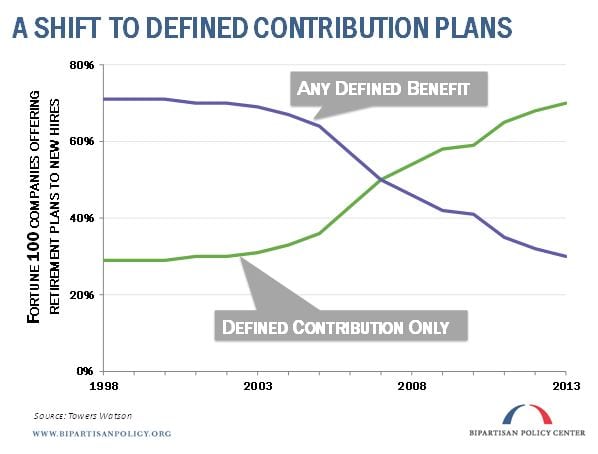

The Legal Issues of Changing Pension Benefits in the UK ... UK employers continue to move away from providing defined benefit pensions as liability reduction and de-risking exercises remain high up the agenda. A multitude of reasons exist for this trend, including the increasing cost to sponsoring companies of providing final salary benefits, increases in pension scheme underfunding coupled with greater employer contributions, the high level […] › loginLog In / Register - RPS Paying into a defined benefit pension 3 things you must do My benefits AVCs: boosting my benefits Your tax limits Looking after your loved ones Life changes Forms Work out your costs Leaving the Scheme Transferring your pension Defined benefit and final salary pensions - Which? A defined benefit pension scheme - sometimes called a final salary or career average pension scheme - is one that promises to pay out an income based on how much you earn when you retire. Pension transfer rules changed from 1st October 2020, but ... The policy statement indicated a range of sweeping reforms in Defined Benefit advice, which came into effect on 1 October 2020. The key changes are outlined below. The end of contingent charging. An adviser can no longer undertake a review of a Defined Benefit Pension without cost and only charge a fee that is contingent upon the transfer.

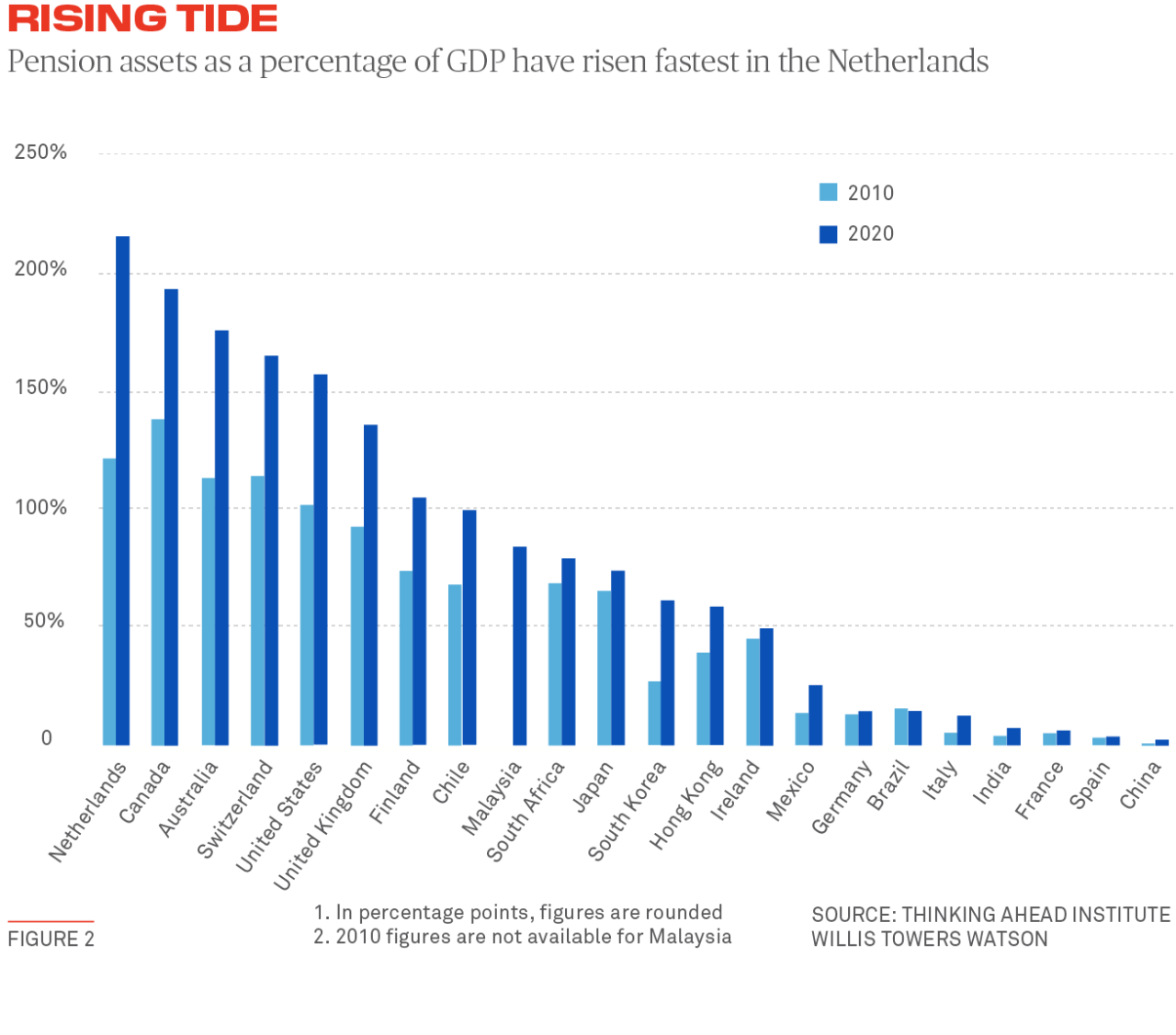

Driving value for money in defined contribution pensions ... 16.09.2021 · 1. Since automatic enrolment (AE) was introduced in 2012, we have seen a dramatic shift in the pensions landscape. Historically, most pension savers had been in defined benefit (DB) schemes, which promised a specific level of income at retirement.

In Defense of Defined-Benefit Pensions - Center for ... First, relatively modest changes to existing defined-benefit pension plans, such as to increase contributions from employers and potentially workers, should significantly correct the underfunding problem that many public pensions currently face.

The Demise of the Defined-Benefit Plan - Investopedia You can put up to $19,500 for the 2021 year in an employer-sponsored defined-contribution plan, and you can add an additional $6,500 if you are aged 50 or older. That amount increases to $20,500...

Summary - Statement No. 68 - GASB Defined Benefit Pensions This Statement requires the liability of employers and nonemployer contributing entities to employees for defined benefit pensions (net pension liability) to be measured as the portion of the present value of projected benefit payments to be provided through the pension plan to current active and inactive employees that is attributed to those …

Changes to Defined Benefit Pension Plan Funding & Defined ... The CARES Act also includes important changes to both defined benefit retirement and defined contribution plans, giving participants access to retirement savings and employers relief for some funding requirements. Defined Benefit Pension Plans Section 3608

PDF Guidance on Single-Employer Defined Benefit Pension Plan ... defined benefit pension plans under § 430 of the Internal Revenue Code (Code) that were made by §§ 9705 and 9706 of the American Rescue Plan Act of 2021 (the ARP), Pub. L. No. 117-2, 135 Stat. 4 (March 11, 2021). Those changes also affect the application of the funding-based limits on benefits under § 436 of the Code.

'Extremely limited' rollover options for defined benefit ... "Where the complying defined benefit pension is a 100 per cent asset test exempt (ATE) pension for Centrelink purposes and retaining the ATE status is a key priority for the SMSF member, the trustee could roll out the assets supporting the complying defined benefit pension to purchase a complying annuity with a life office," the actuarial firm explained.

Notice 2021-48 - KPMG United States the irs released an advance version of notice 2021-48 [pdf 198 kb] as guidance concerning changes to the funding rules for single-employer defined benefit pension plans under section 430—as amended by provisions of the "american rescue plan act of 2021" (pub. l. no. 117-2, march 11, 2021)—and also concerning application of the funding-based …

- Civil Service Pension Scheme Introducing the new Civil Service Pensions Website. We have totally redesigned and rebuilt our website from the ground up. Our aim was to make it easier and quicker than ever for you to find the information and support you need to manage, understand and maximise the benefits of your biggest employment benefit after your salary – your Civil Service Pension.

Uk. Employers Be Aware - Big Changes To The Defined ... Employers be aware - big changes to the defined benefit pensions landscape come into force Some of the biggest changes to the defined benefit pensions landscape in recent years come into force on 1 October 2021. Much has already been made of the provisions of the Pension Schemes Act 2021. Here is a rundown of […]

SECURE Act - What are the defined benefits changes ... Such distributions now may be taken at age 59½ — rather than 62 for pension plans and 70½ for governmental 457 (b) plans. Defined benefit plans, money purchase pension plans, and governmental 457...

Defined Benefit - Pensions - Schroders Defined Benefit. We are focused on helping you generate investment returns while being mindful of risks at each stage of your journey. Whether you need to improve investment returns, develop a long-term strategy, or manage cashflow requirements - our experienced team can help you reach your objectives. Regardless of your size, we can help you ...

Changes to the Centrelink assessment of Defined Benefit ... Changes to the Centrelink assessment of Defined Benefit Income Streams Changes to the Centrelink assessment of Defined Benefit Income Streams From 1 January 2016 there will be a 10% cap on the deductible amount for defined benefit income streams when being assessed by CentreLink's incomes test.

en.wikipedia.org › wiki › Defined_contribution_planDefined contribution plan - Wikipedia A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account.

Pensioners revolt: Patrick Drahi winds up Sotheby's ... In what speculators say are part of plans to float Sotheby's on the New York stock exchang e, owner Patrick Drahi is winding up the firm's "defined benefit" pension plan, with plans to sell it on...

Important Regulatory Updates Impacting Defined Benefit ... There are two key changes, both affect those with defined benefit pension plans. a) A change in the interest rate assumption b) A change in the pension commencement age assumption used to calculate your commuted value.

Employers be aware - big changes to the defined benefit ... Some of the biggest changes to the defined benefit pensions landscape in recent years come into force on 1 October 2021. Much has already been made of the provisions of the Pension Schemes Act 2021. Here is a rundown of what comes into force on 1 October (note that these provisions do not have retrospective effect):

› pers › PagesState of Oregon: Public Employees Retirement System ... PERS provides some online publications in .pdf format. To view them, you must have the most recent version of Adobe Reader ®. Download the latest version of Adobe Reader ®.

Defined benefit pensions - The Private Office It's possible for an employer or trustee to make changes to a defined benefit pension scheme, however the ability to make changes should be set out in your scheme's rules. It's important the rules are followed, and you must be consulted. Section 67 of the Pensions Act 1995 applies to all occupational pension schemes with more than one member.

:max_bytes(150000):strip_icc()/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

0 Response to "41 changes to defined benefit pensions"

Post a Comment