43 403b vs 401k

› how-rollover-403bCan You Rollover a 403b into a Traditional IRA? Absolutely! Aug 20, 2021 · Very thorough and well written post! It’s interesting to see some of the similarities and differences between 401k plans and 403b plans. The process for rolling them over seems similar. My wife and I both have 401k plans and although we have no plans to leave our current employer, when we do we will likely roll them over to an IRA immediately. 403(b) vs. 401(k): What's the Difference? | The Motley Fool The 401 (k) and 403 (b) are both tax-advantaged retirement accounts named after different sections of the tax code. While similar in many ways, 403 (b)s are offered only to public school employees,...

403(b) Vs. 401(k): Comparison, Pros & Cons, Examples 403 (b)s are for government or non-profit employees, while 401 (k)s are offered by for-profit companies. Alyssa Powell/Insider 403 (b) and 401 (k) plans are similar retirement savings tools offered...

403b vs 401k

403(b) vs 401(k) Accounts: What's the Difference? The two most common forms of retirement accounts for employees are the 401 (k) and 403 (b). The 401 (k) retirement plan is offered mostly by for-profit companies, while the 403 (b) is used by non-profits. Occasionally, they are both offered by the same employer. Learn the key differences so that you can choose between them if you need to. 403(b) vs 401(k): Complete Retirement Plans Comparison ... A 403 (b) plan is similar to a 401 (k). The major difference is a 403 (b) plan is used by non-profit companies, religious groups, school districts, and some government organizations. Most workplaces that qualify to offer a 403 (b) will not also provide a 401 (k). And for-profit corporations don't have the option of offering a 403 (b). 401a vs 403b vs 457b: Physician Retirement Plans After some tax law changes in 2006, you can have a stand-alone 401k plan and the match goes right into that 401k. Prior to this and still most commonly, hospitals set up a 403b plan for your employee contributions ($20,500 a year), and the match goes into a 401a.

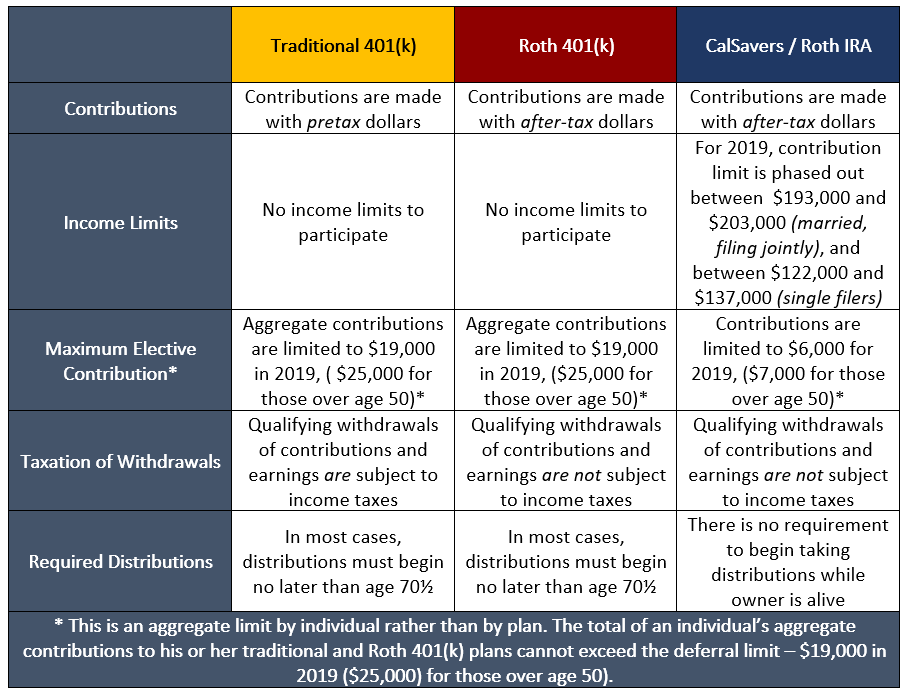

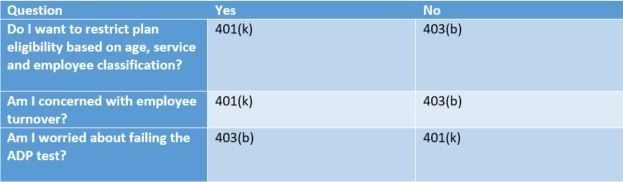

403b vs 401k. › retirement › 401k401(k) Contribution Limits for 2021 vs. 2022 - Investopedia Jan 09, 2022 · The chart below from the Society for Human Resource Management and information from the IRS provides a breakdown of how the rules and limits for defined-contribution plans (401(k), 403(b), and ... 401k vs. 403b: Differences, Advantages & Disadvantages ... A 403b retirement plan is exclusive to employees of non-profit organizations or tax-exempt organizations, like schools and churches. Like the 401k, there are two versions of this plan: a traditional 403b and a Roth 403b. 401k Plan vs. 403(b) for a non-profit organization - 401(k ... The big difference is the universal availability rule—403 (b) plans have to cover everybody, immediately, with limited exceptions. A 401 (k) plan on the other hand can have a service requirement. The flip side of that is a 401 (k) plan is subject to the ADP test whereas a 403 (b) is not. Exactly. 401k vs 403b - What's the Difference in these Retirement ... Both 401k and 403b plans have limits on how much an employee can contribute to them (i.e. maximum 401k contribution limits). For 2011, the standard elective deferral limit is $16,500 for both plans. Further, both allow "catch-up" contributions for employees age 50 and older. These workers can contribute up to a total of $22,000 for 2011, or ...

› learn › content401a vs 401k: What's the Difference? | SoFi Feb 01, 2022 · 401(a) vs Other Retirement Plan Options 401a vs. 403b. A 403b is a tax-advantaged retirement plan offered by specific schools and nonprofits. Like 401(a) and 401(k) plans, employees can contribute with pre-tax dollars. 403b vs 401k: Differences and Similarities - Brandon ... The primary difference between a 403b vs 401k retirement account is who uses them. A 401k is for people employed by a for-profit organization. In contrast, the 403 (b) plan is for those who work for a non-profit organization. Some typical examples include teachers, members of religious organizations, and hospital employees. 403(b) Plan: How it Works and Pros & Cons - The Motley Fool A 403(b) is a retirement savings plan frequently used by educators or non-profit employees. It's similar to a 401(k) but with some key differences. › resources › file-6878242022 403(b) vs. 401(k) comparison chart 2022 403(b) vs. 401(k) comparison chart Feature 403(b) 401(k) Eligible employer Educational organizations and nonprofi t organizations under 501(c)(3) of the IRC Any employer Eligible employees All employees but may exclude: • Employees who work less than 20 hours per week • Professors on sabbaticals • Certain students

403(b) Plan vs. 401(k) Plan: What's The Difference ... A 403b, on the other hand, can only be offered by educational institutions and tax-exempt organizations. All employees are eligible to participate, but the employers may limit their participation rules more tightly than with a 401k. This applies to both government employers and non-profits. Contribution Limits 403(b) vs. 401(k): What's the Difference ... 403(b) and 401(k) plans have a lot in common. You can use either one to chase down your wildest retirement dreams! The main difference between a 403(b) and a 401(k) is the type of employer who offers them. 401(k) plans are offered by private, for-profit companies, but 403(b) plans are offered by nonprofit organizations. 403(b) vs. 401(k) - What's the Difference? - SmartAsset 403(b) vs. 401(k): Differences. There are some noteworthy differences between a 403(b) vs. a 401(k). The most important is the types of companies that offer the two plans. For-profit companies offer 401(k) plans. Most people work at for-profit companies, meaning the majority of retirement plan participants use a 401(k.) 403b Vs. 401k: What's The Difference? | Clever Girl Finance 403b accounts can only offer mutual funds and annuities, while 401ks can offer these plus other types of investments like individual stocks. This isn't that big a deal, since it's usually best to choose from a mix of mutual funds with either account. The 3-fund portfolio is a very simple and well-diversified way to invest in different asset types.

403b vs. 401k: What's the Difference? - Good Financial Cents® 403 (b) plans are very similar to 401 (k) plans, except that where 401 (k) plans are sponsored by for-profit businesses, 403 (b) plans are for not-for-profit organizations that are tax-exempt under IRS Code 501 (c)3. That includes educational institutions, school districts, governmental organizations, religious organizations, and hospitals.

403(b) Plan | What Is It & How Does It Work? A 403 (b) plan is very similar to a 401 (k) plan. Both are offered by employers, and both accounts allow your employer to make contributions to your account. The biggest difference between the two is 401 (k) plans are offered by for-profit companies whereas 403 (b) plans are offered by certain government, nonprofit and religious organizations.

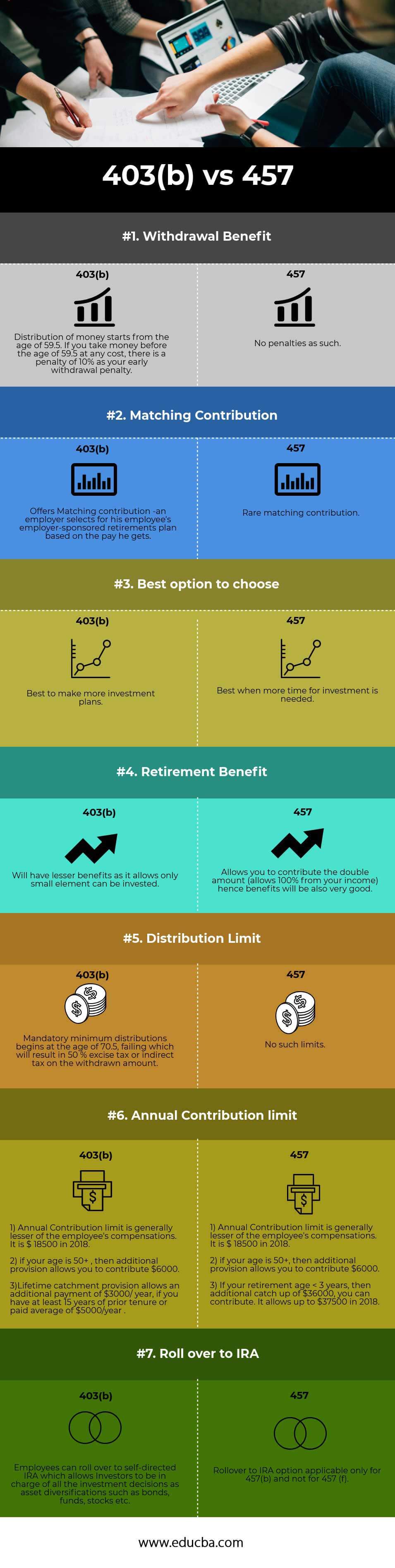

403(b) vs. 401(k) vs. 457(b) | John Hancock Retirement they all allow you to save the same amount of money from your paycheck for the year, although 403 (b)s and 401 (k)s allow for higher contributions from the employer. 403 (b)s and 457 (b)s allow you to make special contributions to increase your retirement savings, but they have different eligibility criteria—you must have 15 years of service for …

Retirement Plans FAQs regarding 403(b) Tax-Sheltered ... Retirement Plans FAQs regarding 403 (b) Tax-Sheltered Annuity Plans. A 403 (b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain 501 (c) (3) tax-exempt organizations. These frequently asked questions and answers provide general information and should not be cited as authority.

› advisor › retirement403b Vs. 401k: What’s The Difference? – Forbes Advisor Dec 03, 2021 · The 403b is for non-profit and government employers, while the 401k is offered by for-profit companies. Employers offer 403(b) and 401(k) plans to help their employees save for retirement, but ...

401(k) vs 403(b): Which Is the Best Choice for My Non-Profit? Typically, a 401 (k) plan is subject to this test, whereas a 403 (b) plan is not. While there are ways for 401 (k) plans to avoid this annual testing, a 403 (b) plan may offer the better opportunity for maximizing deferrals if your organization has HCEs looking to contribute. Wondering about what makes a participant an HCE, we have that info ...

PDF COMPARISON OF 401(k) AND 403(b) PLANS In general, the new regulations narrow the difference between 401(k) and 403(b) plans, making 403(b) plans much more like their 401(k) cousins. ERISA vs. non-ERISA plans - 403(b) plans without employer contributions, or those sponsored by governmental employers or churches will not automatically be subject to ERISA.

403(b) vs 401(k) - What's the Difference? How Are They the ... 401 (k) = For-profit / private companies 403 (b) = Tax-exempt organizations like public schools, hospitals, churches, etc. Are they the same thing as a "pension"? Same. Nope. Not at all. A pension is something totally different.

403b vs 401k Plans: What's Better For Retirement ... Another key difference is that 403b plans tend to have lower expense ratios, since they are subject to less stringent reporting requirements. This translates into lower fees or management costs for employees. Finally, 401k plans tend to be administered by mutual fund companies.

› 403b-rollover-rulesWhat are the 403b Rollover Rules? | IRA vs 401k Central Jun 22, 2014 · 403b accounts are very similar to 401k plans that are offered to employees of larger for-profit and private companies. If you have a 403b plan and you are leaving your employer, you might want to roll the funds in your account over to another type of retirement plan.

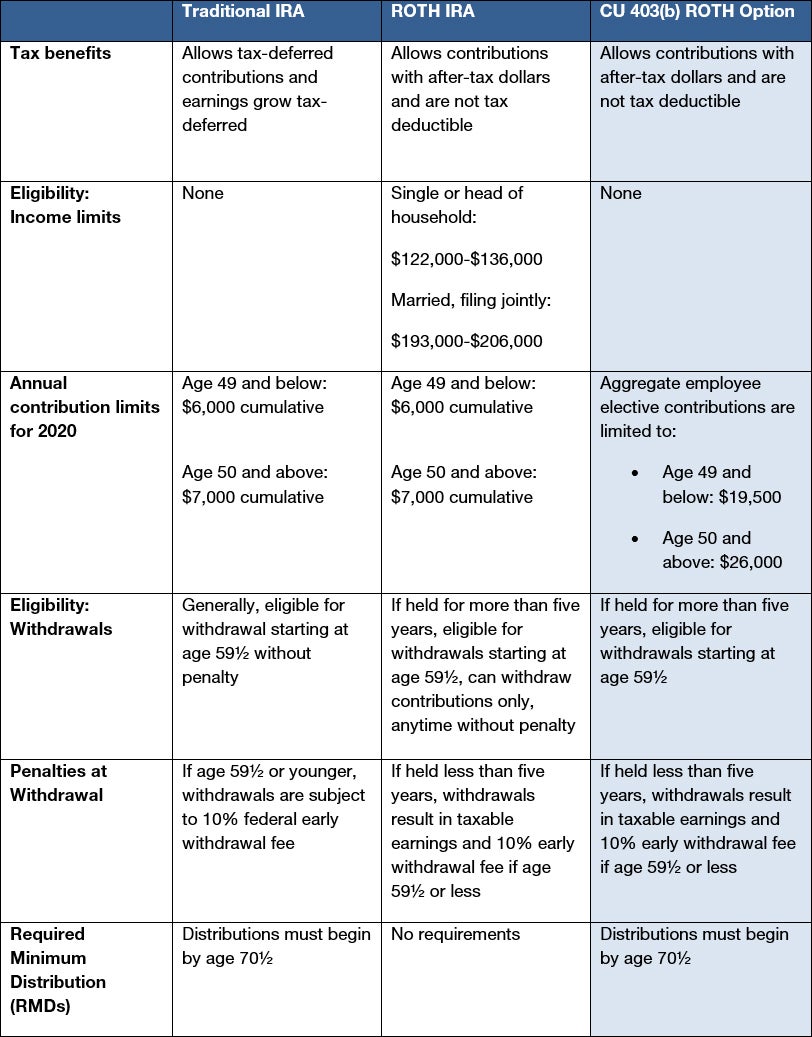

401(a) vs. 403(b) | What You Need to Know - SmartAsset Tax Benefits of 403(b) Plans. In terms of tax treatment, a 403(b) functions similarly to a 401(a). You make pre-tax contributions, and your money grows tax-free. However, you will owe regular income tax on eligible withdrawals. You can also make these at age 59.5. The 10% early-withdrawal penalty rule applies. 403(b) Plan Contribution Limits

403(b) vs. 401(k): What's the Difference? — Tally There are also employer-sponsored retirement plans, like a 403(b) or 401(k). Confusingly named, both offerings may appear to be a jumbling of letters, numbers and punctuation. While they share similarities, 403(b)s and 401(k)s do have a few distinguishing differences. In this article, we'll provide: A breakdown of 403(b) vs. 401(k)

401(k) vs. 403(b): What's the Difference and Which is ... Differences in Investment Options for 401(k) vs. 403(b) As noted above, 401(k) plan participants tend to have a larger menu of investment options than 403(b) plan consumers, who are usually ...

› ask › answersThe Differences Between 401(k) and 403(b) Plans Notably, 401 (k) plans tend to be administered by mutual fund companies, while 403 (b) plans are more often administered by insurance companies. This is one reason why many 403 (b) plans limit...

401a vs 403b vs 457b: Physician Retirement Plans After some tax law changes in 2006, you can have a stand-alone 401k plan and the match goes right into that 401k. Prior to this and still most commonly, hospitals set up a 403b plan for your employee contributions ($20,500 a year), and the match goes into a 401a.

403(b) vs 401(k): Complete Retirement Plans Comparison ... A 403 (b) plan is similar to a 401 (k). The major difference is a 403 (b) plan is used by non-profit companies, religious groups, school districts, and some government organizations. Most workplaces that qualify to offer a 403 (b) will not also provide a 401 (k). And for-profit corporations don't have the option of offering a 403 (b).

403(b) vs 401(k) Accounts: What's the Difference? The two most common forms of retirement accounts for employees are the 401 (k) and 403 (b). The 401 (k) retirement plan is offered mostly by for-profit companies, while the 403 (b) is used by non-profits. Occasionally, they are both offered by the same employer. Learn the key differences so that you can choose between them if you need to.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/agreement-and--discussion-1189829021-109d3b8bd8854ad1b0b7b981355d0571.jpg)

0 Response to "43 403b vs 401k"

Post a Comment