40 share buyback meaning

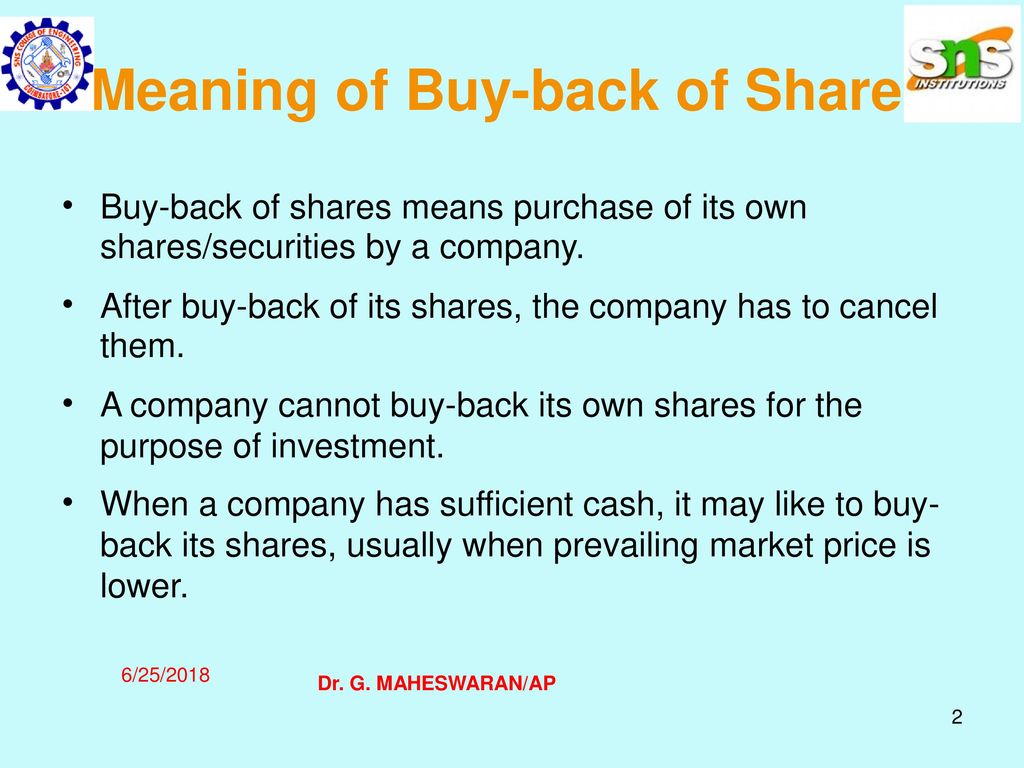

Buyback Definition A buyback is when a corporation purchases its own shares in the stock market. A repurchase reduces the number of shares outstanding, thereby inflating (positive) earnings per share and, often, the... Buyback Definition & Meaning - Merriam-Webster The meaning of BUYBACK is the act or an instance of buying something back; especially : the repurchase by a corporation of shares of its own common stock usually on the open market. How to use buyback in a sentence.

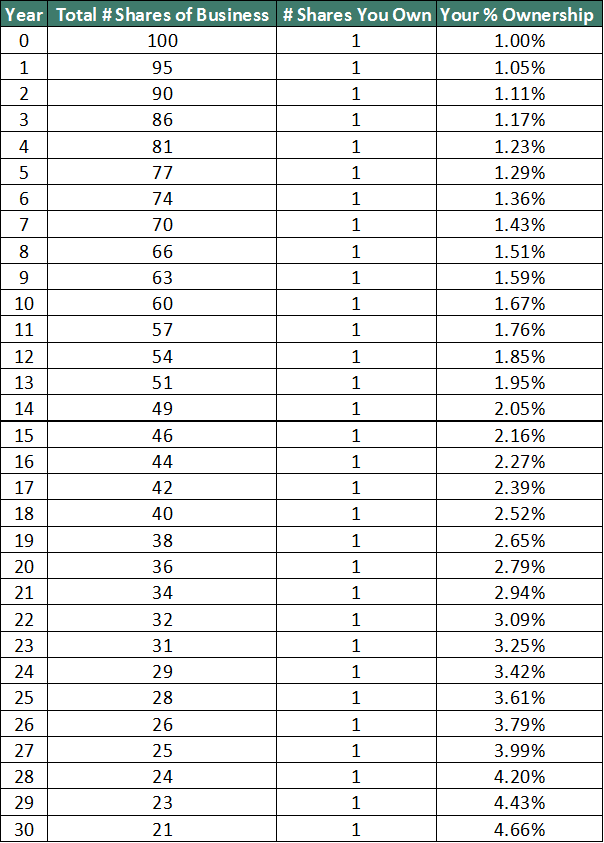

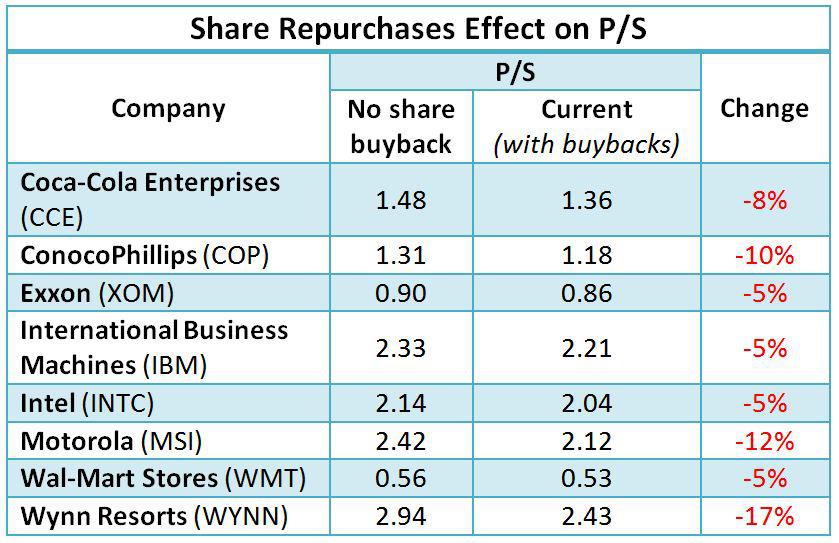

Share buyback financial definition of share buyback share buyback the purchase by a company of its own shares, thereby reducing the amount of its ISSUED CAPITAL. Share buybacks are undertaken to return 'surplus' cash reserves to shareholders; more particularly, they are undertaken to increase earnings per SHAREand DIVIDENDper share and thus (hopefully) lead to a rise in the company's share price.

Share buyback meaning

60 second guide: Share buybacks - CommBank Share buyback explained A buyback is when a company offers to re-purchase some of its shares from existing shareholders. The net effect is a reduction in the total number of a company's shares on issue. Share Buybacks: What It Means And How It Impacts Investors Definition of 'Share Buyback' A share buyback, or repurchase, is a move by a listed company to buy its own shares. This can be from the open market, issuing a tender offer, or arranging for a private buyback from a shareholder (s). Share buybacks are a corporate action that require companies to make a public filing with regulators. What Is A Stock Buyback? - Forbes Advisor In a stock buyback, a company purchases shares of stock on the secondary market from any and all investors that want to sell. Shareholders are under no obligation to sell their stock back to the...

Share buyback meaning. › Corporate+News › CovenantCovenant Logistics (CVLG) Announces $30M Share Buyback ... Feb 10, 2022 · Covenant Logistics Group, Inc. (NASDAQ/GS: CVLG) (Covenant or the Company) announced today the adoption of a $30 million stock repurchase program and an acquisition.Stock Repurchase ProgramOn ... Share Buyback (Definition, Examples) | Top 3 Methods Share buyback refers to the repurchase of the company's own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company's balance sheet thereby raising the worth of remaining outstanding shares or to block the control of various shareholders on the company. › globalassets › documentsInforma to divest Pharma Intelligence for £1.9bn and commence ... Share Buyback Programme Alongside investing for growth, the Group has previously announced its intention to return a proportion of the proceeds from the divestment of Informa Intelligence to shareholders. Following today’s binding agreement for the Pharma Intelligence business, the Group intends to commence a share buyback Buyback 2022: Upcoming & Latest Share Buyback Offers with ... Buyback of shares or stock buyback refers to the corporate action in which a company repurchases its own shares from the existing shareholders. During the buyback of shares, the price of shares is usually premium than the market price. Buyback of shares can be done via the open market or through tender offer route.

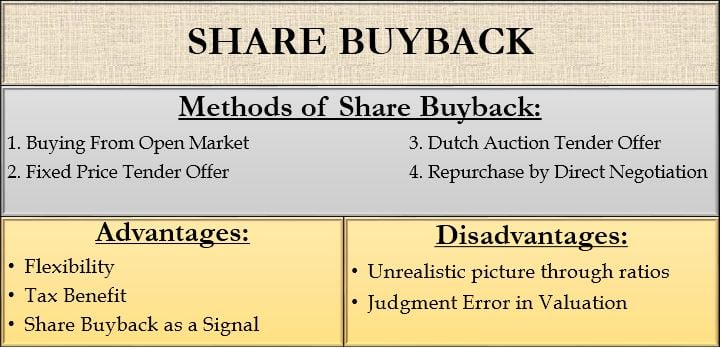

Share Buyback | Definition, Example, Methods, Purposes What is Share Buyback? A share buyback is a transaction in which a company buys back its own shares from the open market. Another term for it is share repurchase. There are various methods to buyback shares. The company can buy back the shares from the market or tender offer. What is BuyBack of Shares? | Why Companies Buy Back Their ... BuyBack of shares is a concept when a company buys back its own shares from the existing shareholders, to reduce the number of shares available in the open m... Share Buyback - Advantages, Disadvantages, and How Does It ... Share buyback The share buyback is when companies buy back their own shares from the shareholders. There are multiple logics and methods that why the companies opt for buying back. However, shareholder's approval is required for the successful execution of the transaction. The methods and reasons for the implementation of the buyback program have been … Share Buyback - Advantages ... What Is Buyback of Shares - Meaning, Process, Reasons and ... What is share buyback? Companies can sometimes decide to purchase their own shares from the open market, which they issued earlier, through a process called share buyback. When a company wants to buy back shares, it publicly announces its intention to do so through various channels.

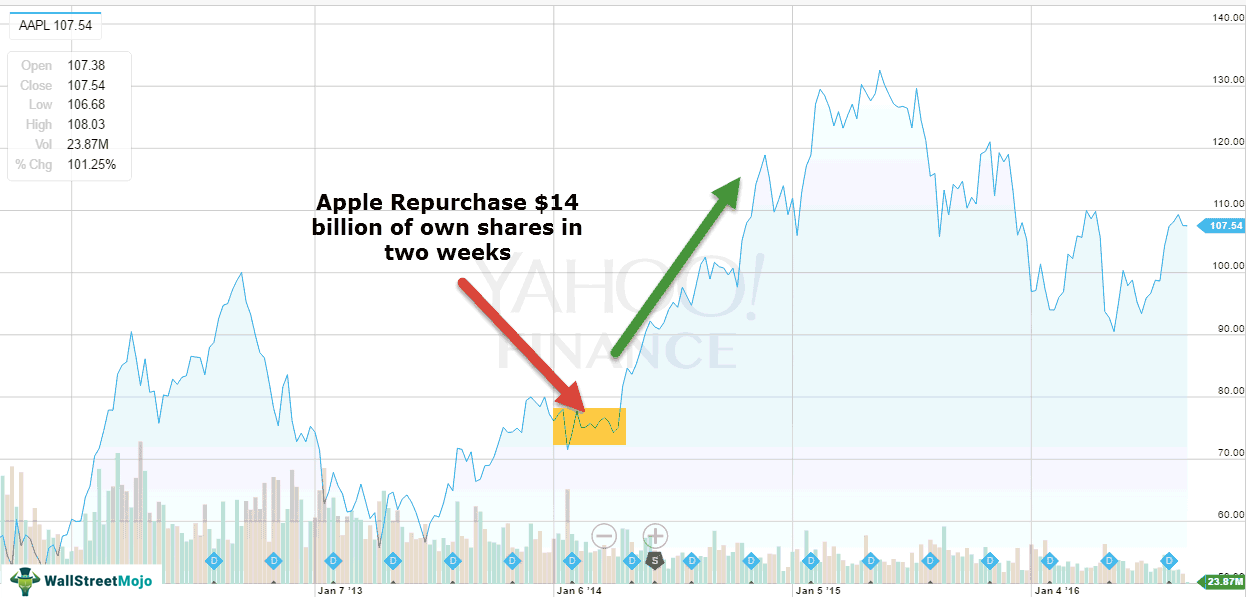

What is a share buyback? | Share repurchase definition | IG SG Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future. Share Repurchase - Overview, Impact, and Signaling Effect When a company buys back shares, it may be an indication that the company is facing very positive prospects that will place upward pressure on the stock price. Examples may be the acquisition of another strategically important company, the release of a new product line, a divestiture of a low-performing business unit, etc. Share repurchase - Wikipedia Share repurchase (or share buyback or stock buyback) is the re-acquisition by a company of its own shares. It represents an alternate and more flexible way (relative to dividends) of returning money to shareholders.. In most countries, a corporation can repurchase its own stock by distributing cash to existing shareholders in exchange for a fraction of the company's outstanding equity; that is ... Buyback of Shares - Meaning, Reasons, Methods and ... Explaining what the buyback of shares is? A company can repurchase its own shares from an individual or a group of investors under the term buy back of shares. The buy-back is duly completed at a slightly higher price than the market value. The buyback of shares may be initiated by a company for various reasons, including the following.

Share Buyback | Reasons of Share Buyback | Share Buyback ... The buyback of the shares is done when the company repurchases its own shares from the market. These shares are those which are already sold to private and public investors. Buyback of the shares is generally done at a higher price which is more than the market price of the share.

Stock Buybacks: Why Do Companies Buy Back Shares? A buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private...

SHARE BUYBACK | meaning in the Cambridge English Dictionary share buyback noun [ C ] FINANCE, STOCK MARKET uk us (also stock buyback) an offer by a company to buy shares of its own stock from shareholders: Analysts still expect a share buyback at some stage. The company is pressing ahead with a €750 million share buyback programme. See also buyback Want to learn more?

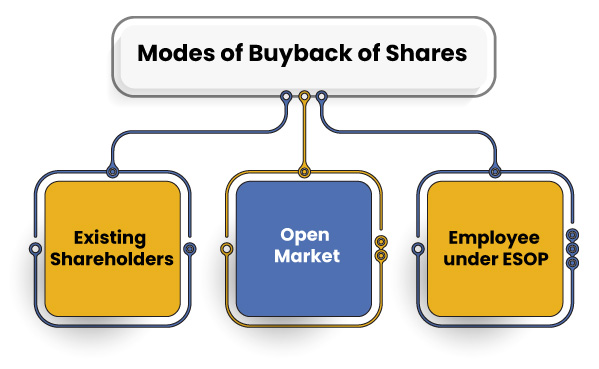

Share buy backs | ASIC - Australian Securities and ... This type of buy-back, referred to as an employee share scheme buy-back, requires an ordinary resolution if over the 10/12 limit. A listed company may also buy back its shares in on-market trading on the stock exchange, following the passing of an ordinary resolution if over the 10/12 limit. The stock exchange's rules apply to on-market buy-backs.

Buyback of Shares Meaning, Procedure and Taxation Explained Buyback of shares meaning A buyback of shares is buying back of own shares by a company that was issued earlier. It is a corporate action event wherein a company makes a public announcement for the buyback offer to acquire the shares from existing shareholders within a given timeframe.

What is a Share Buy-Back & How Does It Work? | Canstar A share buy-back happens when shareholders are invited to sell some of their shares back to the company. Here's how it works.

What is a share buyback? | Share repurchase definition Share buyback definition What is share buyback? Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future.

› blog › types-of-shareholdersTypes of Shareholders - Meaning & Example of Shareholders Sep 08, 2020 · Equity shareholders are entitled to Bonuses and Rights and can also participate in Buyback. Further, equity shareholders can also be categorized as per their shareholding pattern into promoters, Institutional investors (foreign and domestic), and the public. 2. Preference Shareholder:

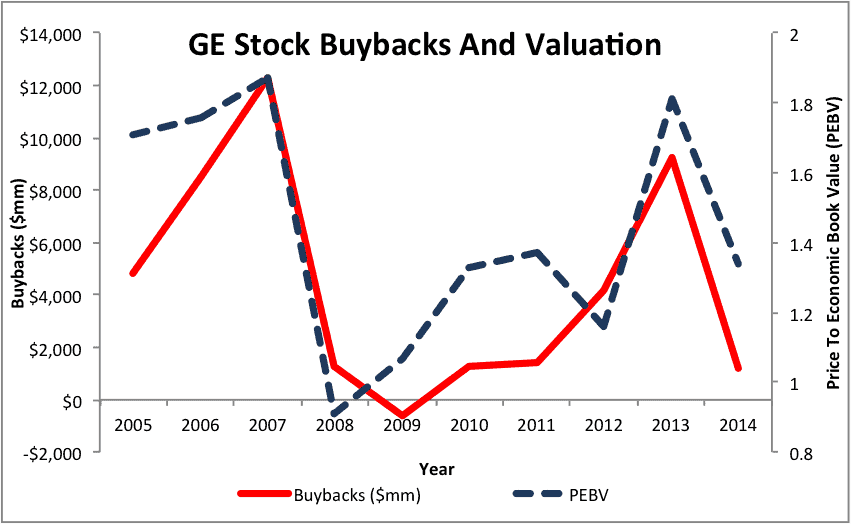

finbold.com › guide › stock-buyback-definitionWhat is a Stock Buyback? Definition & Benefits of Share ... Jan 12, 2022 · A stock buyback will often follow a successful period, meaning the company will have to buy its own stock at a higher valuation. For investors though, it can be tricky to suss out whether a company’s decision to repurchase shares is a sound one or one motivated by manipulating financial metrics and therefore ultimately misleading.

Share Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It's simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common, is...

Share buyback - what this is and what a company needs to do A buyback of shares is where the company buys some of its own shares from existing shareholders. There are three types of share buyback: Purchase of own shares. Share redemption. Share capital reduction by: cancelling shares. repaying share capital. reducing the nominal value of a share class.

TCS share price rises marginally on last day of buyback ... The buyback is being done at Rs 4,500 per share - over 21 per cent premium to current market price. TCS shares were trading flat at Rs 3,706 on the Bombay Stock Exchange. The buyback offer ...

What Is A Share Buyback? Definition, Meaning & Basics Of ... In a share buyback, a company announces a price at which it is ready to buy shares from shareholders within a given time frame. Typically, companies with high cash reserves use the buyback route to reduce the number of shares in the market. Fewer shares can help return ratios and a reduced supply of shares can boost stock prices.

What Is A Stock Buyback? - Forbes Advisor In a stock buyback, a company purchases shares of stock on the secondary market from any and all investors that want to sell. Shareholders are under no obligation to sell their stock back to the...

Share Buybacks: What It Means And How It Impacts Investors Definition of 'Share Buyback' A share buyback, or repurchase, is a move by a listed company to buy its own shares. This can be from the open market, issuing a tender offer, or arranging for a private buyback from a shareholder (s). Share buybacks are a corporate action that require companies to make a public filing with regulators.

60 second guide: Share buybacks - CommBank Share buyback explained A buyback is when a company offers to re-purchase some of its shares from existing shareholders. The net effect is a reduction in the total number of a company's shares on issue.

/buyback-f91333fa039d4d79ab430c65fc753e11.jpg)

0 Response to "40 share buyback meaning"

Post a Comment